W 4 Single And 0

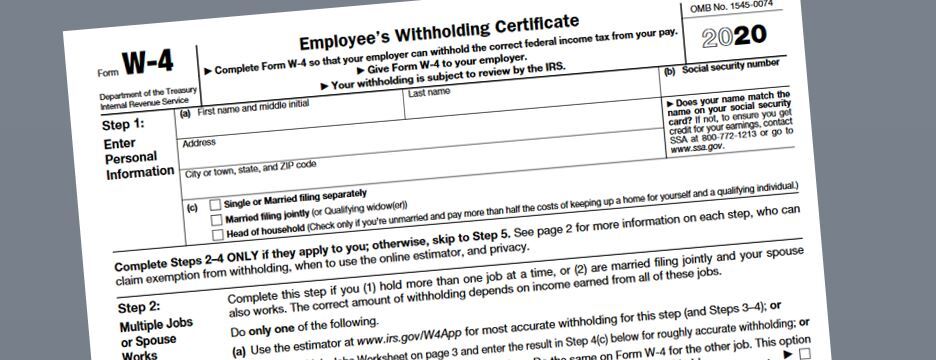

2020 W-4 Calculator & Form Changes Get the refund you want – or have more money now. Update your W-4 form with help from Block. Your paycheck and tax refund are impacted by how you complete your W-4. Use our W-4 calculator to help you adjust your IRS withholdings, so you get the refund you want at tax time – or more money in your pocket now. Most people receive W-4 forms from their employers when they begin working. Payroll departments use the information employees provide on their W-4 forms to determine how much money should be withheld from their paychecks for federal taxes. If you've just entered the workforce, filling out a W-4 form for the first time can be confusing. Say the employee marked “Single” on the 2019 and earlier Form W-4, claimed 1 withholding allowance, and did not request any additional withholding amounts. Fill out the latest W-4 form, which is the 2021 Form W-4. Here’s how the computational bridge would look in action: The employee’s filing status on the 2021 Form W-4 would be. How to Complete a Form W-4 If Single & No Dependents By Jack Ori Updated March 28, 2017 When you start a new job, you must fill out a W-4 form telling your employer how much tax to withhold from your paychecks. The number of exemptions you claim affects the withholding amount, but you might get a refund when you file taxes.

Year after year, many Americans are thrilled to receive a huge refund check from Uncle Sam after they’ve filed their taxes. I’m as excited as the next person to receive a wad of unexpected cash, but I also know that by getting a big refund from the IRS, I’ve basically given the government an interest-free loan of my money.

When it comes to your taxes, you should really aim for a modest refund each year, as that means you’re not having too much taken from each paycheck and you’re not scrambling to pay a bill come April. If you regularly receive a refund of $1000 or more, make this the year you do more with your money than just lend it to the IRS.

1. Talk to your HR department to get a new W-4. You probably filled one of these bad boys out when you were first hired, and it’s likely you haven’t seen the form since. But it’s a good idea to review this document periodically — like when you get married or divorced, have children, or buy a new home. Even if none of these things have happened, it’s a good idea to fill one of these out again if you know you can count on a hefty refund each spring.

2. Calculate your withholding allowances. Despite the fact that the withholding allowances that you enter into your W-4 form does not determine your tax bill, only how much you pay in taxes per paycheck, many people (myself included!) are nervous about the idea of taking more allowances than we always have. The IRS provides a withholding calculator that can help you to determine exactly how many you can take.

However, it is good to remember the common allowances you can take:

W 4 Single 0 Or 1

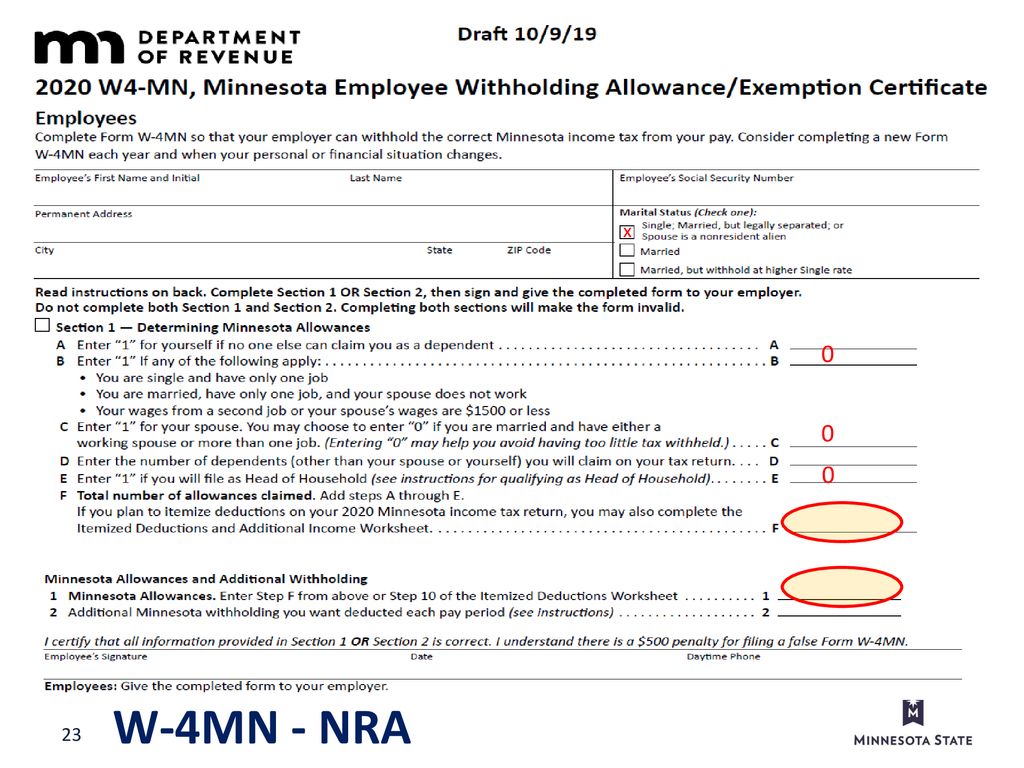

- One allowance if you are single and have only one job.

- One allowance if you have one job and your spouse is not employed.

- One allowance if your income from a second job or your spouse’s income is $1500 or less

- One allowance if you spend at least $1800 per year in child or dependent care expenses and plan to take a tax credit.

3. Determine how the allowances will best be split up between married couples. If you and your spouse are both working, you will want to figure out how many allowances you are both entitled to as a couple, and then divide them up however you choose. Generally, you will want to have the higher-paid spouse claim the allowances, as they will often have a greater impact, in terms of reduced withholding, with a higher salary.

According to Turbo Tax Online, married couples often under-withhold (that is, they don’t pay enough from each paycheck), so it is important to make sure you calculate correctly, particularly if this is your first year of married life. The W-4 worksheet offers a second page for married couples that will help you determine the correct number of allowances to make sure you don’t have a nasty surprise in April, 2013.

4. Once you file your new W-4 with your employer, you’ll soon see fatter paychecks. Generally, it takes about a month for the new paperwork to make a difference in your paydays.

With the extra money you’re seeing each month, you could beef up your retirement savings or savings for Junior’s college fund. The best use of that money is putting it somewhere where it could earn you more. Then you’ll know you’re using the money to its best advantage.